Review of Trades and Trading Tips for the Euro

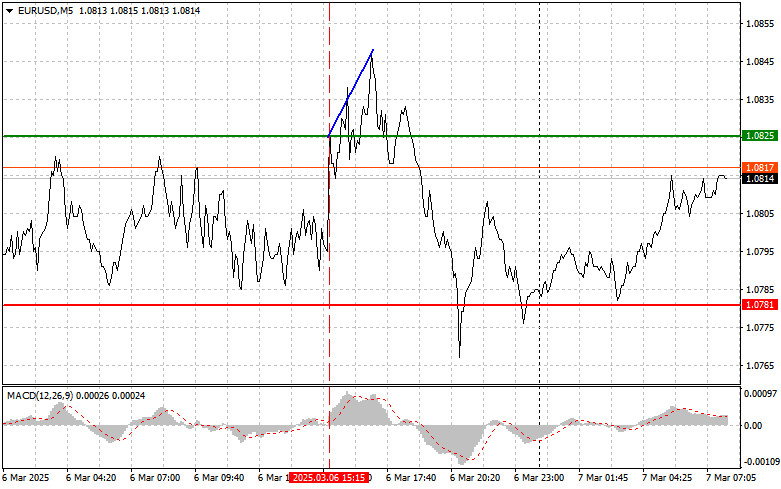

The test of the 1.0825 level coincided with the moment when the MACD indicator was just starting to move up from the zero mark, confirming a valid entry point for buying the euro. As a result, the pair rose by 20 points, but after updating the weekly high, demand for the euro quickly faded.

Yesterday's decision by the European Central Bank to cut interest rates, along with statements about continuing this policy, limited the growth of the EUR/USD currency pair. However, whether downward pressure on the euro returns will depend on macroeconomic conditions. Persistently high inflation could force the ECB to slow the pace of rate cuts, which would support the euro. Conversely, weak economic growth in the eurozone could encourage further monetary easing, putting additional pressure on EUR/USD.

Today, key economic data releases are expected, including Eurozone Q4 GDP, employment change figures, German industrial orders, and France's trade balance.

These indicators are crucial for assessing the region's economic health and growth prospects. Weak GDP data could heighten recession fears, while negative employment trends would further dampen consumer demand. The German industrial order volume is a key indicator for the entire eurozone; a decline could signal slowing industrial production and negatively affect GDP. The French trade balance reflects the country's competitiveness in global markets; a deficit could indicate export challenges and the need for trade policy adjustments.

For intraday trading, I will primarily rely on Scenarios #1 and #2.

Buy Scenarios

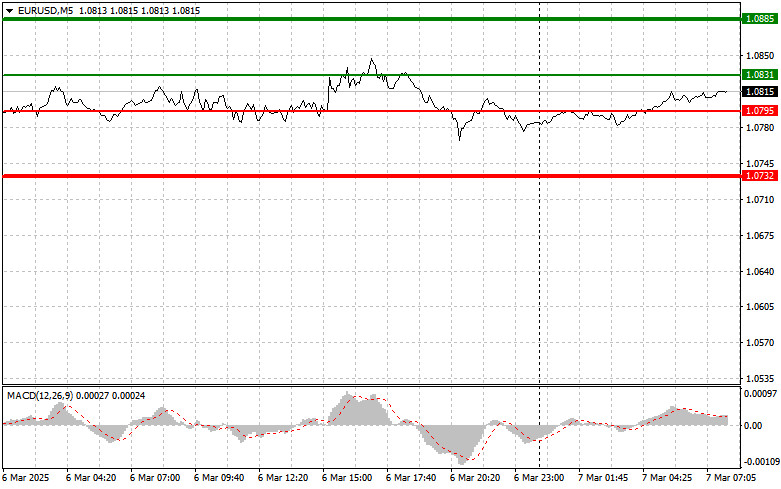

Scenario #1: Buying the euro is possible upon reaching 1.0831, targeting 1.0885. I plan to exit the market at 1.0885 and sell in the opposite direction, expecting a pullback of 30–35 points. The euro's growth in the first half of the day will depend on strong macroeconomic data from the eurozone. Important! Before buying, ensure that the MACD indicator is above the zero mark and just starting to rise.

Scenario #2: Another buying opportunity arises if the price tests 1.0795 twice, while the MACD indicator is in oversold territory. This would limit the downward potential and trigger a market reversal to the upside. In this case, the expected growth targets would be 1.0831 and 1.0885.

Sell Scenarios

Scenario #1: Selling the euro is possible after reaching 1.0795, targeting 1.0732, where I plan to exit the trade and immediately buy in the opposite direction, expecting a 20–25 point retracement. Bearish pressure will return if eurozone data disappoints. Important! Before selling, ensure that the MACD indicator is below the zero mark and just starting to decline.

Scenario #2: Another selling opportunity arises if the price tests 1.0831 twice while the MACD indicator is in overbought territory. This would limit the pair's upward potential and trigger a downward reversal. The expected downward targets would be 1.0795 and 1.0732.

Key Chart Elements

The thin green line marks the entry price for buying the instrument. The thick green line represents a potential Take Profit level or an area where profit should be locked in, as further growth above this level is unlikely.

The thin red line marks the entry price for selling the instrument. The thick red line represents a potential Take Profit level or an area where profit should be locked in, as further decline below this level is unlikely.

The MACD indicator is essential for determining overbought and oversold conditions before entering trades.

Important Notes for Beginner Forex Traders

New traders should be extremely cautious when entering trades. Before major fundamental reports are released, it's often best to stay out of the market to avoid getting caught in sharp price fluctuations. If trading during news releases, always use stop-loss orders to minimize risk. Trading without stop-loss protection can result in significant losses, especially when using large positions and poor money management strategies.

For successful trading, having a well-defined trading plan is crucial—similar to the one outlined above. Making spontaneous trading decisions based on the current market situation is generally an unsuccessful strategy for intraday traders.