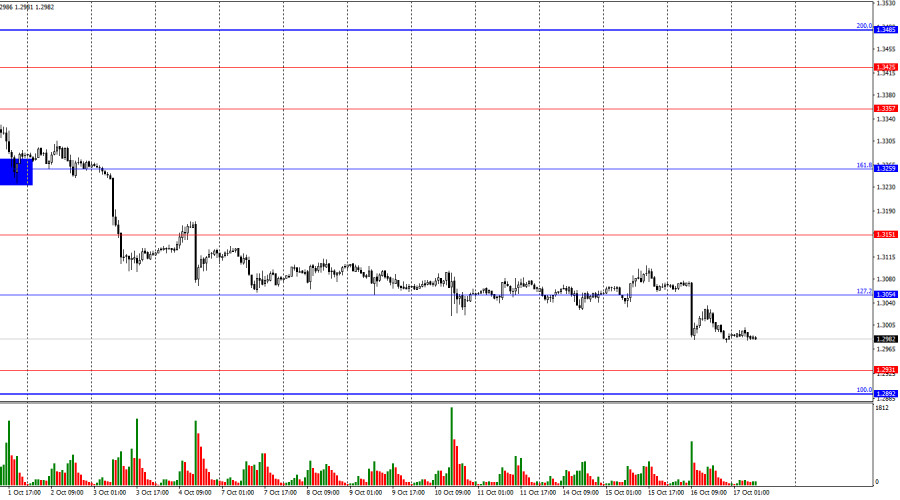

On the hourly chart, the GBP/USD pair consolidated below the 127.2% corrective level at 1.3054, which suggests a continuation of the decline towards the support zone of 1.2892 – 1.2931. A reversal from this zone could support the British pound and lead to some growth towards the 1.3054 level. At the moment, there are no indications or signals for the beginning of an upward movement.

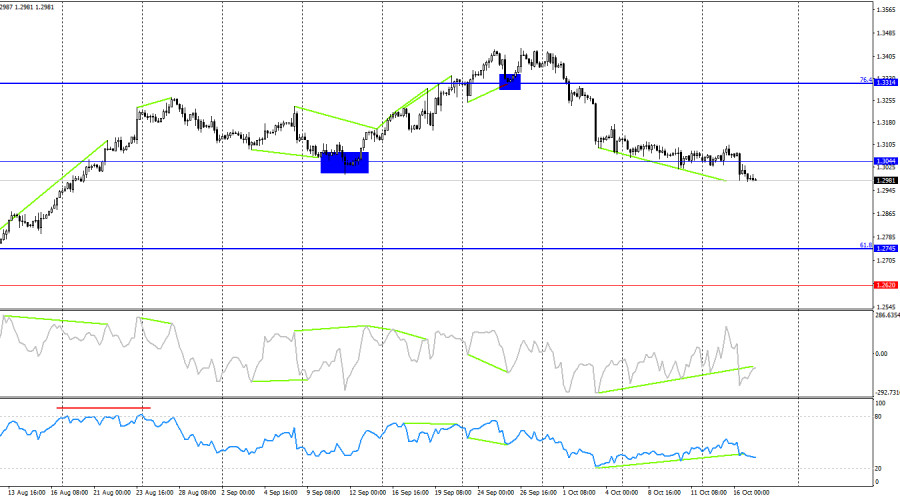

The wave pattern is clear. The last completed upward wave (September 26) did not break the previous wave's peak, and the downward wave that has been forming for 15 days has easily broken the low of the previous wave, which was at the 1.3311 level. Therefore, the bullish trend is considered to be complete, and a bearish trend has begun to form. A corrective upward wave may be expected from the 1.2931 level, but signals need to form first.

On Wednesday, only one report attracted traders' attention. The UK Consumer Price Index slowed to 1.7%, while traders were expecting a decline to a maximum of 1.9% year-over-year. The core CPI fell to 3.2% year-over-year, with forecasts at 3.4%. Thus, inflation in Britain continues to fall, and it is doing so rapidly enough that the Bank of England may resume monetary policy easing. In recent weeks, traders have been buying the dollar as the pressure from U.S. monetary policy easing has diminished. Previously, traders had been waiting for the Federal Reserve to begin rate cuts and feared rapid easing, as there were expectations for 6-7 rate cuts at the start of the year. However, after September 18, it became clear that the FOMC was not in a rush to ease. Later, it became known that inflation was slowing more gradually than expected, unemployment was falling, and the labor market was recovering after a nearly six-month period of underperformance. Therefore, there is no reason for a rapid rate cut, which supports the dollar.

On the 4-hour chart, the pair consolidated below the 1.3044 corrective level, which suggests a further decline towards the next 61.8% corrective level at 1.2745. For more than a week, both indicators have been signaling a bullish divergence, which warned of a potential reversal from the 1.3044 level. However, the reversal did not occur. Bears are showing that the trend has shifted to a downward one, as they ignore the bullish divergences. A correction is likely to happen, but probably later.

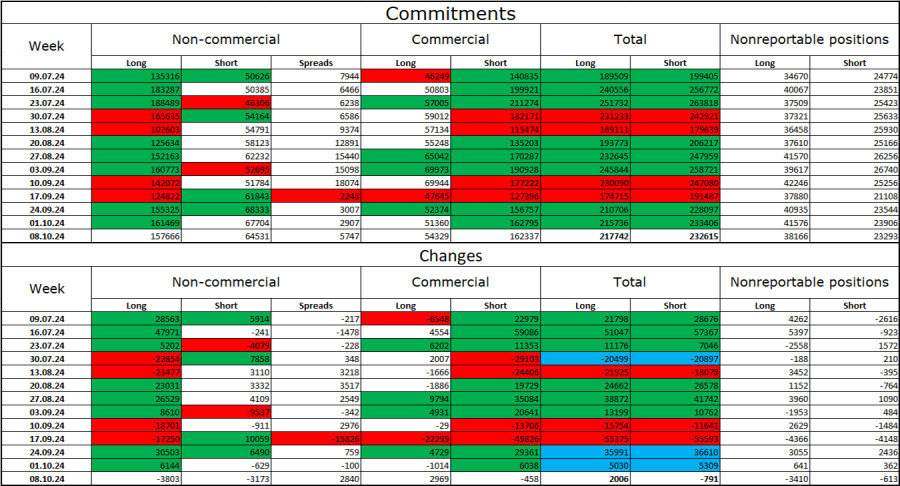

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category did not change during the last reporting week and remains bullish. The number of long positions held by speculators decreased by 3,803, and the number of short positions decreased by 3,173. Thus, professional players have been reducing long positions and increasing short positions for two weeks, but they are now buying the pound again. Bulls still hold a solid advantage. The gap between the number of long and short positions is 93,000: 158,000 versus 65,000.

In my opinion, the pound still faces the prospect of falling, but the COT reports currently suggest otherwise. Over the past three months, the number of long positions has increased from 135,000 to 158,000, while the number of short positions has grown from 50,000 to 65,000. I believe that over time, professional players will reduce their long positions or increase their short positions, as all possible factors for buying the British pound have already been priced in. Graphical analysis indicates that this process may start soon.

News Calendar for the U.S. and UK:

U.S. – Retail Sales Change (12:30 UTC)

U.S. – Philadelphia Manufacturing Index (12:30 UTC)

U.S. – Initial Jobless Claims Change (12:30 UTC)

U.S. – Industrial Production Change (13:15 UTC)

Thursday's economic event calendar includes several interesting reports from the U.S. The impact of this data on market sentiment in the second half of the day is expected to be moderate.

GBP/USD Forecast and Trading Tips:

Selling the pair was possible on the hourly chart after a reversal from the 1.3425 level, with targets at 1.3357, 1.3259, 1.3151, and 1.3054. All targets have been reached. New sales could have been opened yesterday after the 4-hour chart closed below 1.3044, with a target at 1.2931. I do not see any potential signals for buying at this time.

Fibonacci levels are drawn between 1.2892 – 1.2298 on the hourly chart and 1.4248 – 1.0404 on the 4-hour chart.