On Thursday, the GBP/USD currency pair also began a slight downward correction. While the pound did not depreciate significantly, explaining why it rose for two weeks is difficult. Of course, Donald Trump's tariffs, which could trigger a recession in the U.S. economy and globally, are a strong reason to sell the dollar. However, is the market getting ahead of itself? As mentioned, nothing catastrophic has happened to the U.S. economy yet. Moreover, the Federal Reserve still does not intend to cut interest rates more than twice in 2025, while the European Central Bank and the Bank of England remain much more dovish. If we disregard the news about Trump's tariffs, what other reasons exist for the euro and the pound to rise against the U.S. dollar? The British economy remains weak and stagnant. The BoE is forced to cut rates even if it does not want to—economic stimulus is necessary. Trade negotiations between London and Washington, aimed at avoiding tariffs, have yielded no concrete results. Dealing with Donald Trump is always tricky; one can only accept his terms.

Thus, we will not be surprised if the British pound starts moving toward its yearly lows. The currency has again risen where there was no fundamental reason for growth. The pound has climbed due to a single factor, while the market has ignored everything else. In the daily time frame, it is evident that despite the strong rise in recent weeks and even months, the downtrend remains intact—even the medium-term one that began in September last year, not to mention the 16-year downtrend that started in 2008. To be honest, the recent growth of the pound appears to mark the start of a new trend. However, it is still too early to say whether this is a trend or a substantial correction.

We still see no solid reasons for the pound to continue rising. Of course, there is the Trump factor, and the market has already demonstrated its reaction to his decisions. Thus, if the U.S. president continues making controversial decisions to fulfill his imperial ambitions, the dollar could resume its decline. It's important to emphasize that significant changes in the economy and monetary policy are genuine issues, not just worries about potential problems. For instance, last year, markets anticipated 6 to 7 cuts in the Fed's interest rates, but only three cuts actually occurred. Nevertheless, the market had already priced in all seven anticipated cuts.

If a decline begins now, we will fully support it and consider it justified. However, for this to happen, the price must first consolidate below the moving average—not just for a couple of hours, but confidently.

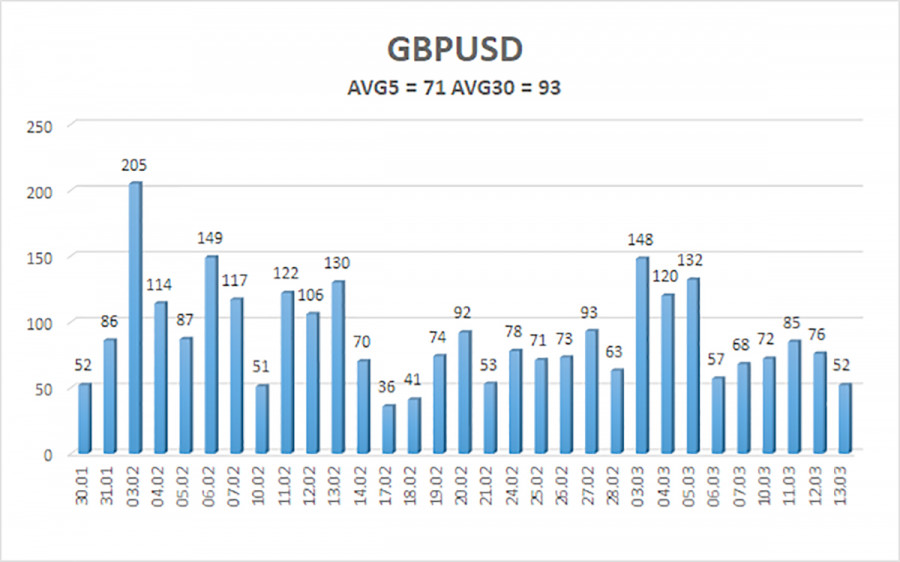

The average volatility of the GBP/USD pair over the last five trading days is 71 pips, which is classified as "moderate" for this pair. On Friday, March 14, we expect the pair to move between 1.2873 and 1.3015. The long-term regression channel has turned upward, but the downtrend remains visible on the daily time frame. The CCI indicator has recently avoided both overbought and oversold zones.

Nearest Support Levels:

S1 – 1.2939

S2 – 1.2817

S3 – 1.2695

Nearest Resistance Levels:

R1 – 1.3062

R2 – 1.3184

R3 – 1.3306

Trading Recommendations:

The GBP/USD pair maintains a medium-term downtrend. We still do not consider long positions, as we believe the current upward movement is merely a correction that has turned into an illogical, panic-driven rally. If you trade purely based on technical analysis, long positions are possible with targets at 1.3015 and 1.3062, provided the price remains above the moving average. However, sell orders remain far more relevant, with targets at 1.2207 and 1.2146, as the upward correction on the daily time frame will inevitably end sooner or later. The pound appears extremely overbought and unjustifiably expensive, but Donald Trump continues to push the dollar downward. How much longer this dollar collapse will last remains highly uncertain.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.