Analysis of Trades and Trading Tips for the Euro

The test of the 1.0224 price level in the second half of the day coincided with the MACD indicator just beginning to move upward from the zero mark, confirming a valid entry point for buying the euro. As a result, the pair rose by more than 50 pips.

Reports suggest that President Donald Trump's economic team members are discussing a gradual monthly increase in tariffs. This approach aims to avoid a sudden inflation spike while allowing other countries to adapt to the new tariffs, mitigating economic damage. Proponents argue that this move could protect domestic industries, create jobs, and boost demand for American goods while reducing import dependency and enhancing the economy's resilience to external shocks. On the other hand, critics warn of potential negative consequences, such as higher consumer prices and risks to international trade relationships.

Today, the euro's growth during the first half of the day hinges on positive economic indicators that could boost investor confidence. The ZEW Economic Sentiment Index for Germany serves as a crucial barometer for expectations regarding future economic growth. Strong results from this index could signal a recovery in key economic sectors, fostering both investment and consumer spending, which would support the euro. Equally important is the ZEW Index for the Eurozone as a whole. Positive outcomes from this index could not only strengthen confidence in Germany's economy but also enhance perceptions of stability across the region. Sustainable growth in major Eurozone economies would further increase the euro's appeal on the global stage.

Additionally, attention should be given to Italy's industrial production data. As one of the largest economies in the Eurozone, shifts in its industrial sector can significantly affect the region's economic health. Increased production volumes can lead to job creation and higher household incomes, thereby bolstering demand and supporting the euro.

The focus will primarily be on implementing Scenarios #1 and #2 for both buying and selling.

Buy Signal

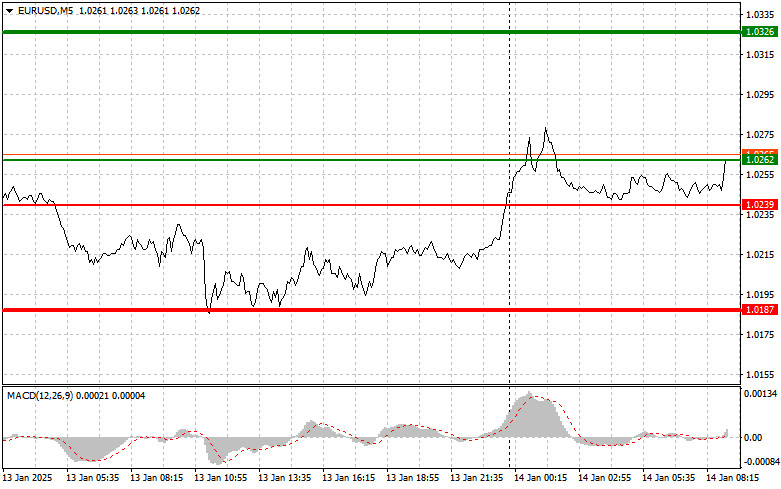

Scenario #1: Buy the euro upon reaching the 1.0262 level (green line on the chart), targeting a rise to 1.0326. At 1.0326, plan to exit the market and open a short position in anticipation of a 30-35 pip decline from the entry point. Condition: Expect euro growth only if the economic data is positive. Ensure the MACD indicator is above the zero mark and beginning to rise before entering the trade.

Scenario #2: Consider buying the euro after two consecutive tests of the 1.0239 level, provided the MACD indicator is in oversold territory. This will limit the pair's downside potential and prompt an upward market reversal. Anticipate growth toward the opposite levels of 1.0262 and 1.0326.

Sell Signal

Scenario #1: Sell the euro after reaching the 1.0239 level (red line on the chart). The target is 1.0187, where you should exit the market and consider opening a long position in the opposite direction, aiming for a 20-25 pip rebound. Condition: Ensure the MACD indicator is below the zero mark and beginning to decline before initiating the trade.

Scenario #2: Sell the euro after two consecutive tests of the 1.0262 level, provided the MACD indicator is overbought territory. This will limit the pair's upside potential and prompt a market reversal downward. Expect a decline to the opposite levels of 1.0239 and 1.0187.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.