On Monday, the GBP/USD currency pair gained about 100 pips even before the beginning of the U.S. trading session, which is typically the most volatile. Let's analyze the factors behind the rise of the British pound. From our perspective, the most reasonable explanation for this increase relates to "Donald Trump and his policies." As we have previously cautioned, the market would eventually recognize that Trump poses a threat to the U.S. economy. In the short term, his actions may bring additional revenue to the U.S. Treasury, but in the long run, they risk dismantling essential economic ties. Yes, many countries will continue to conduct business and trade with the U.S., but who wants to partner with a nation that consistently threatens, insults, imposes sanctions and tariffs, and exploits its economic and military power?

We believe the market is becoming increasingly aware that nothing beneficial will come from America's situation under Trump. How should one react to statements from the president of one of the world's strongest nations, such as, "Give us Greenland, the Panama Canal, and let Canada become part of America"? Such remarks seem better suited for a dystopian novel than for a reality that purportedly strives for democracy. However, we won't delve too deeply into politics. The crucial point is that there were no macroeconomic factors driving the rise of the British pound on Monday.

The only report from the UK—the second estimate of the February manufacturing PMI—came in slightly above the forecast, but it was just a second estimate. It's unlikely that the market bought pounds overnight just because business activity declined somewhat less than expected. Besides, the indicator remains below the key 50.0 level, which is still in negative territory. Apart from unresolved developments from Friday, there were no other major news events in the first half of the day.

Thus, we can draw only one conclusion: the dollar fell "because of Trump" and may continue to decline if the U.S. president continues handling affairs in this manner. Frankly, we are still surprised that he hasn't yet suggested making Russia the 52nd U.S. state or giving Taiwan to China for free.

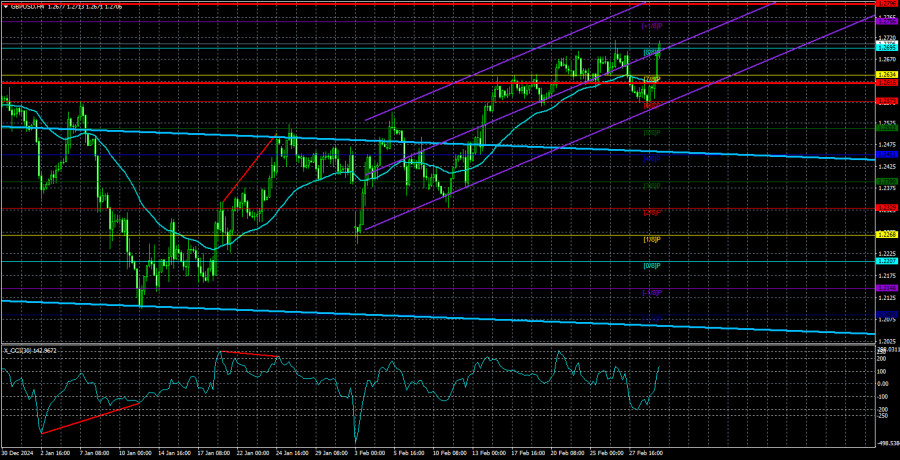

The new rise of the British currency in the daily timeframe does not appear illogical. The upward correction is ongoing, even though it seemed last week that it was ending. At this point, the pair has corrected by 40% of the previous decline—not a significant rebound. A correction up to 50% is possible, with that level at 1.2765. Regarding longer-term movements and forecasts, our stance remains unchanged. The U.S. dollar still looks more attractive than the euro or the pound. The only "headache" for the dollar is Donald Trump. We fully acknowledge that the market may avoid the U.S. dollar and American investments due to his presidency. However, this remains speculation, and the current movement is still a technical correction. Therefore, it is too early to draw loud conclusions about a global or medium-term trend reversal.

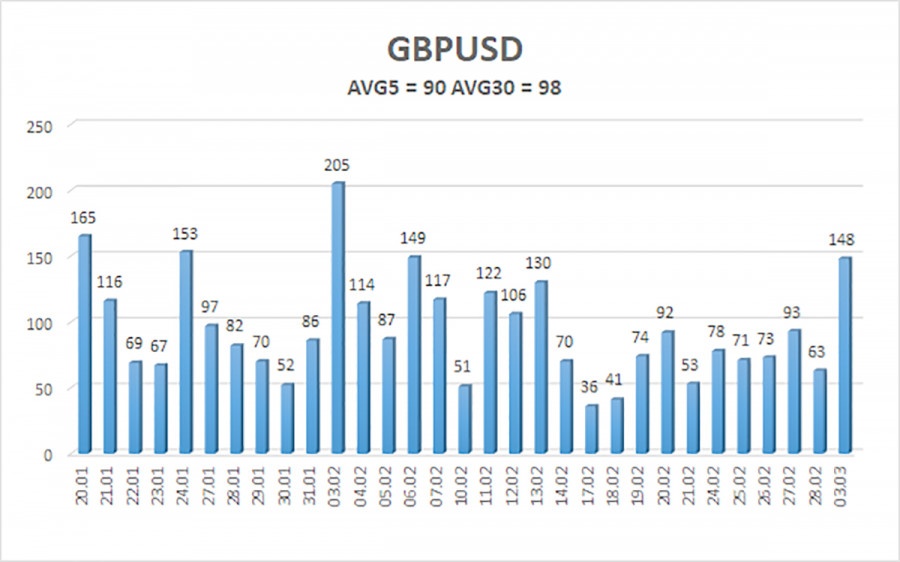

The average volatility of the GBP/USD pair over the last five trading days is 90 pips, which is considered "moderate" for this pair. On Tuesday, March 4, we expect movement from 1.2616 to 1.2796. The long-term regression channel remains downward, signaling a continued bearish trend. The CCI indicator recently entered the overbought zone, indicating a potential decline.

Nearest Support Levels:

S1 – 1.2634

S2 – 1.2573

S3 – 1.2512

Nearest Resistance Levels:

R1 – 1.2695

R2 – 1.2756

R3 – 1.2817

Trading Recommendations:

The GBP/USD pair maintains a medium-term downward trend. We still do not consider long positions, as we believe the current upward movement is merely a correction. If you trade purely on technical analysis, long positions are possible, with targets at 1.2756 and 1.2796 if the price moves above the moving average. However, sell orders remain much more relevant, with targets at 1.2207 and 1.2146, as the upward correction on the daily timeframe will eventually end. A firm break below the moving average is needed for this scenario. The pound is already looking locally overbought.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.